Exposing the hidden world of market research fraud

By Kapil Kale and Kate Monica●6 min. read●Oct 11, 2024

In 2020, Dan Wasserman of KJT was sitting in front of a spreadsheet of survey data when he noticed something strange.

This newest batch of data defied any recognizable pattern. Responses were disjointed and inconsistent.

Dan and his team always reviewed survey data as part of their data quality checking process. But rarely did they discover so many nonsensical responses.

“Something about it wasn’t adding up,” Dan said.

Dan worked with this team to review the metadata.

Several IP addresses were clustered, suggesting respondents were using multiple devices in the same household. Unusual, given the study targeted physicians. He also checked the timestamps of the surveys.

“They were completing them really quickly, and at weird times of day,” he said.

The metadata confirmed Dan’s growing suspicion: KJT had fallen victim to fraud.

In total, the losses were just under $30K – more than anyone wants to lose to fraud, but not a devastating amount. Mostly, KJT was relieved to have caught the fraud before allowing their client to make business decisions based on junk data.

“For me, the biggest focus was, ‘I don’t want to give my client bad data,’” said Dan.

KJT has a tested data review practice, so the firm was able to catch the fraud before things got out of hand. But finding that a market research study has been sullied by spam data is nerve wracking, costly, and demoralizing nonetheless.

At Tremendous, we’ve had countless clients reach out after similar incidents in a state of panic, floored at the magnitude of their losses. One client lost $2.9M to fraud in just one year.

For me, the biggest focus was, 'I don't want to give my clients bad data.'

Dan Wasserman, COO at KJT

KJT is just one of the thousands of market research firms targeted by fraudsters each year. Fraud is a longstanding issue in the market research industry, but there have been few efforts to clarify just how big the problem is.

We recently analyzed Tremendous’ internal data to understand the state of market research fraud in 2024. We learned that fraud losses number in the hundreds of millions, with nearly half of all market research firms affected.

The size and shape of the problem

Quantifying the fraud problem is tricky by design. Fraudsters are masters of disguise. Their livelihood depends on obscuring their identity.

As a payouts provider for more than 1,000 clients in the market research space, Tremendous is uniquely positioned to scope the issue.

We analyzed data from thousands of transactions across our research clients for obvious indicators of fraud: individuals cycling through different email addresses, for example, or pooling funds to a single PayPal account. Below are the most striking findings from our analysis.

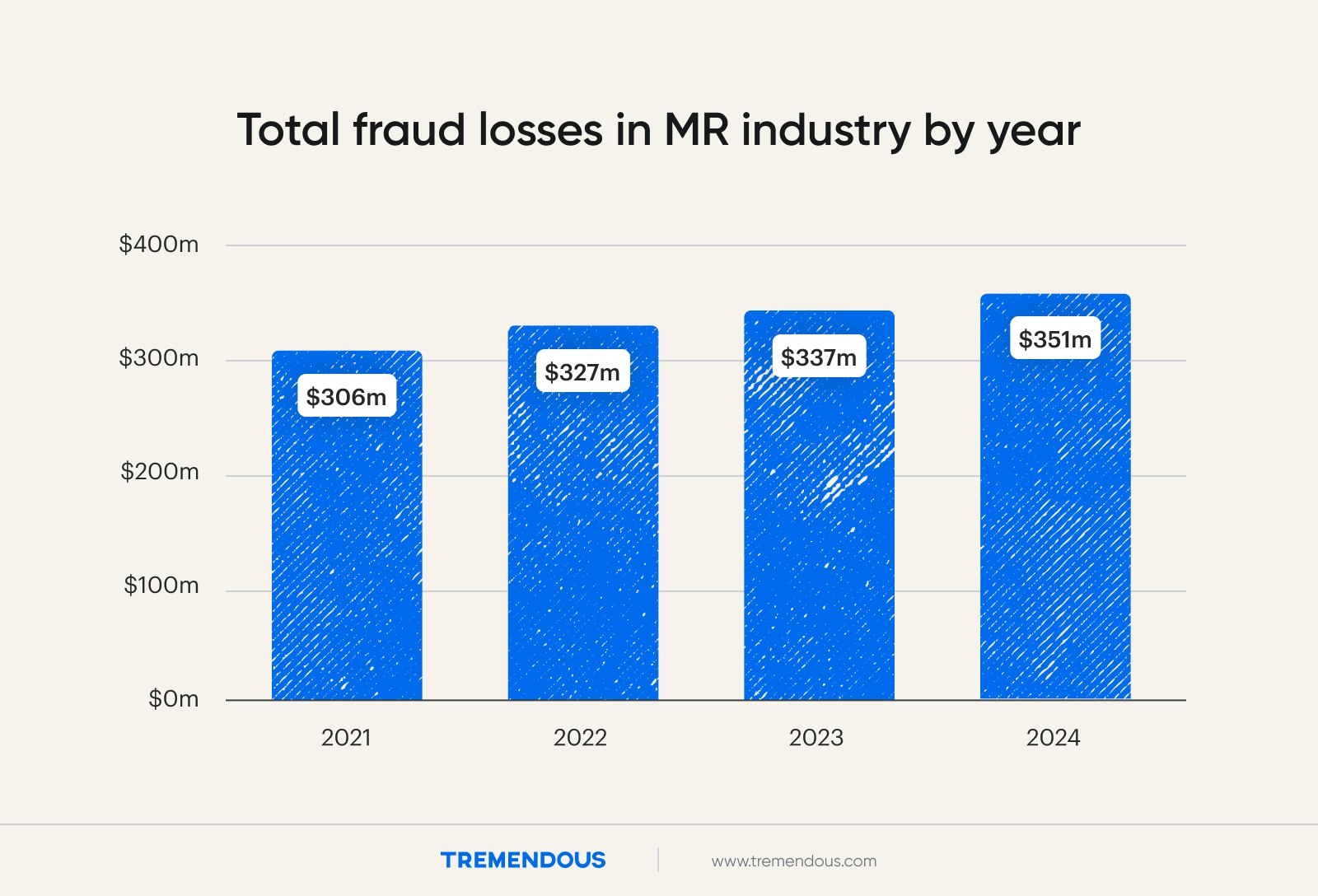

Fraud losses to reach $350M in 2024

Our estimates suggest the global market research industry will lose roughly $350M to fraud in 2024¹. This amount represents 5% of total reward and incentive spend across the industry.

In our dataset, 40% of market research firms experienced some amount of fraud in 2024. On average, those firms lost $25K.

Some market research firms are getting totally fleeced

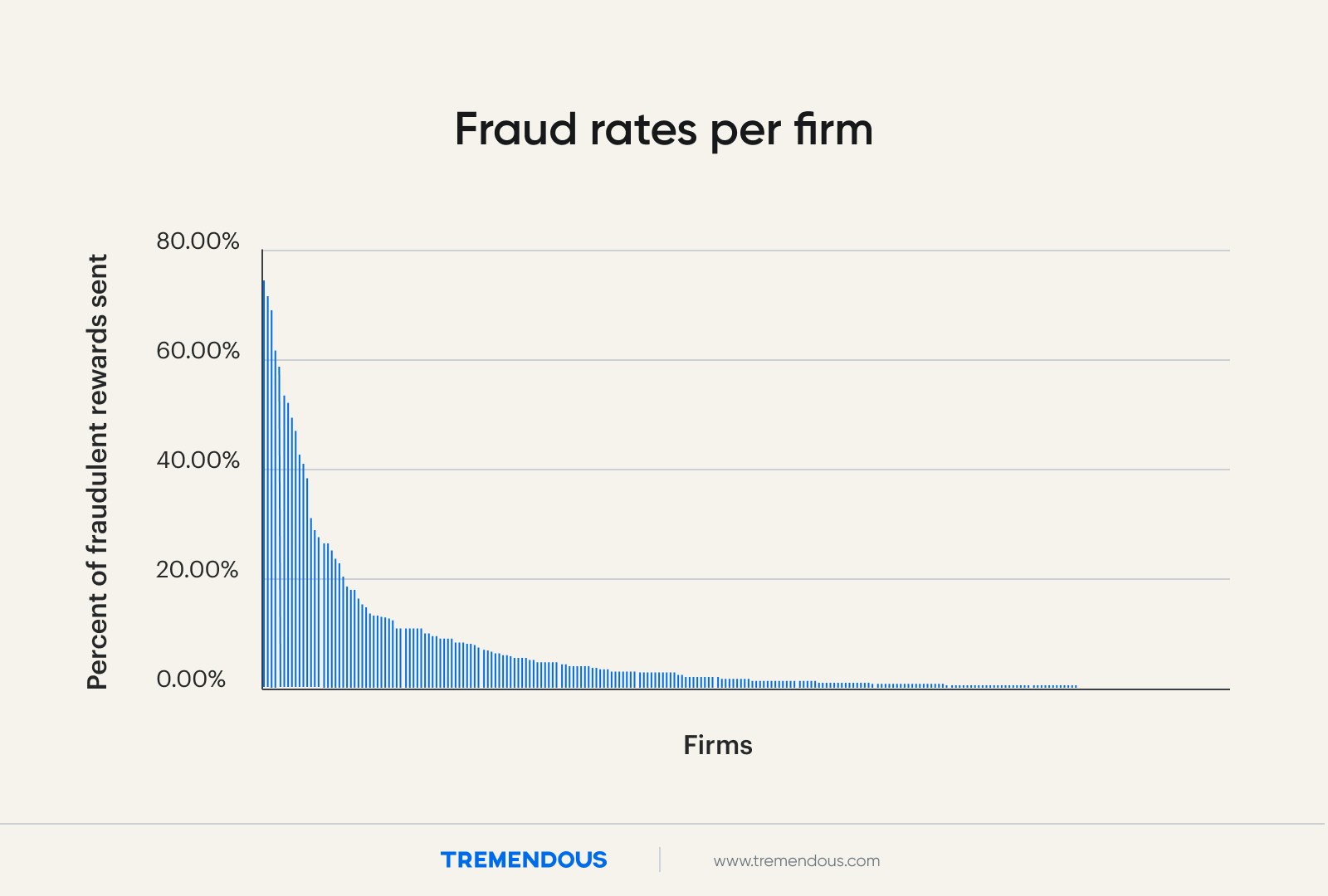

Our data showed a tale of two firms: those who have the fraud problem under control already, and those who are getting robbed.

Many of the firms in our dataset lose 1% or less of their spend to scammers. A portion of the firms we analyzed didn’t send any money to obviously fraudulent recipients.

But others are overrun by fraud, and likely aren’t aware of the degree of losses they’re facing.

20 research firms using Tremendous were experiencing fraud rates of over 20% of their spend, meaning $1 of every $5 they spent went to fraudsters.

Who’s behind all of this?

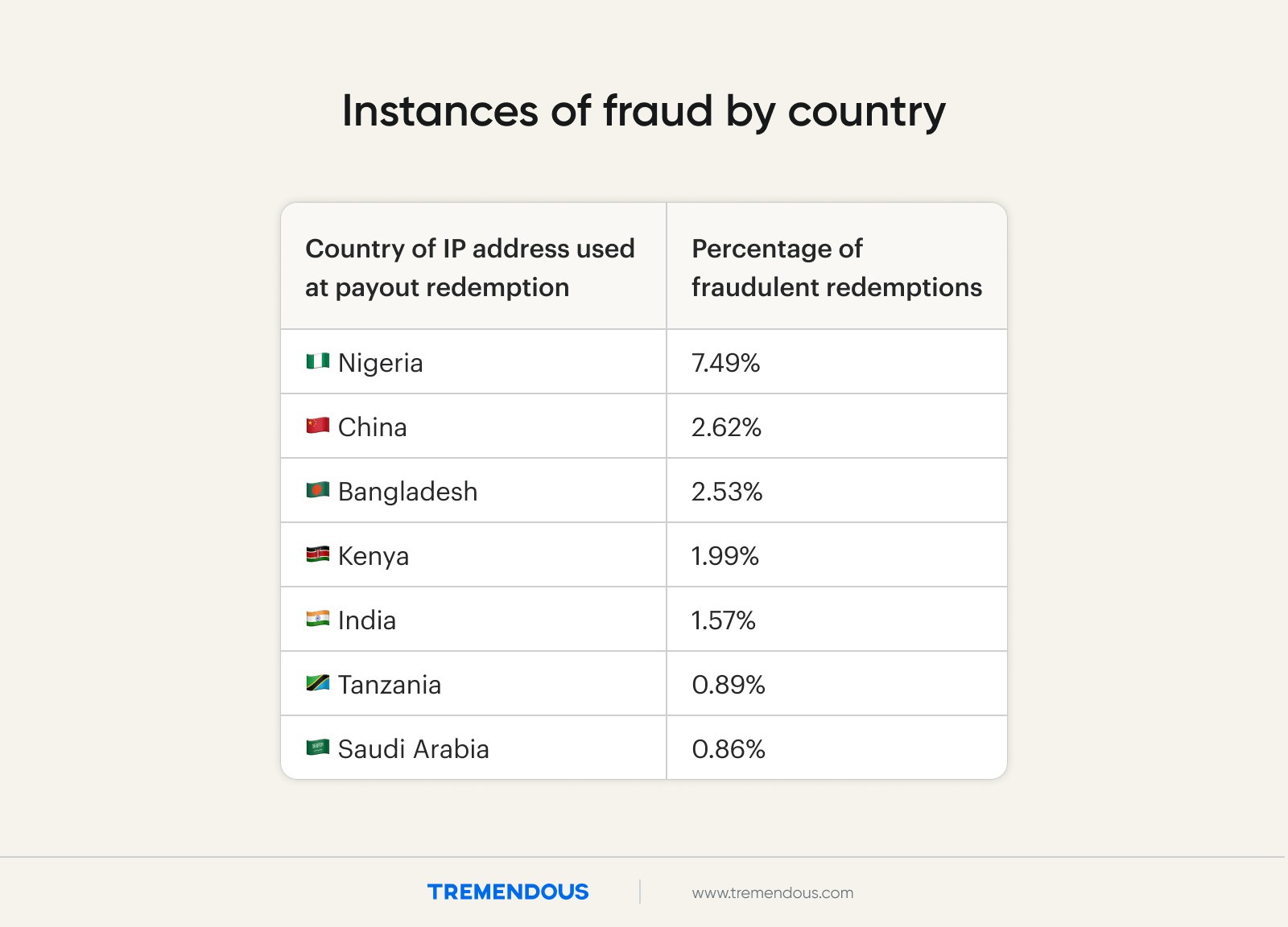

While fraudsters will generally use VPNs or proxies to mask their identities, a percentage in our dataset did not. Using IP geolocation data, we found most of the fraud on our platform that isn’t obscured by a VPN originates in Nigeria.

Putting an end to fraud

KJT escaped their encounter with fraud relatively unscathed. But our analysis revealed that other market research organizations aren’t so lucky.

So what’s the fix?

It starts with market research firms implementing tools to get their individual problem under control. “If we aren’t using the security measures we have available to deal with it, we’re just encouraging people who commit fraud to commit fraud again,” said Dan.

There are a number of ways market research firms can shield themselves from scammers:

Use identity verification methods - ideally multiple. When enrolling respondents, assess and verify them with email addresses and phone numbers.

Implement anti-fraud solutions. Some research firms build custom anti-fraud tools, which might incorporate IP identification, activity scoring, and identity challenges. These can be time-consuming and costly to build, but the overall cost savings can be $100K+ annually.

Implement a payouts provider with fraud prevention built in. Tremendous’ free fraud prevention tools identify and block fraud at the point of payout. For firms that lack an antifraud solution, Tremendous can block scores of fraudsters based on country, IP address, or receiving threshold. Even if you have your own tooling in place, Tremendous provides a second layer of defense, allowing you to close gaps you may not have foreseen. Book a meeting with us and we’ll help you understand whether our solution can help.

Above all, the industry needs to work together to normalize discussion around the problem and share the knowledge and tools that are most effective in combatting it.

“The conversation is getting a lot more open about this,” said Dan. “To me, that’s a positive sign.”

Footnotes

¹Using 2024 projected industry revenues of $84B from Statista [source], an estimated 8% of revenue spent on incentives, and a fraud rate of 5% from Tremendous internal research

² Dataset generated by running IP addresses used for redemption. We excluded the US, UK, Canada, and Germany, since fraudsters will generally use VPNs associated with westernized nations to mask identity.

³ We notified all of these firms and many have already enabled our fraud prevention offering.