Key takeaways

Fraud occurs in roughly 4 out of 10 market research studies, with common tactics including phone farms, AI-generated responses, and IP spoofing.

The most effective prevention strategies combine digital fingerprinting, multi-step verification, and shared industry watchlists to stop fraudsters before they contaminate your data.

Fraud runs rampant in market research today. Estimates vary, but our own data shows that up to 40% of firms experience some sort of research incentive fraud.

Fraudsters are like evil locksmiths with a sophisticated toolkit to force their way in. They seek to bypass your security doors, create bogus accounts, submit fake responses, and earn money. And their shady tactics get more advanced every day.

Let’s explore some common fraud methods used by scammers in the market research world, and what you can do to stop them. From simple protection actions to bringing on more advanced platforms, we’ll teach you how to fight fraud and protect your research budget, data, and reputation.

Who commits market research fraud?

Their motivation is simple: Fraudsters practice their dark arts for financial gain. By posing as relevant participants and completing research studies at scale, they can make easy money quickly. And with the boom of online surveys to gather consumer feedback on markets and products, there’s no shortage of targets.

How fraudsters operate

Fraudsters have plenty of tricks up their sleeves. They can fake emails, LinkedIn profiles, device types, and IP addresses, making it difficult or near impossible to track them down.

Some know how to write code and implement automation, which allows them to generate large volumes of phony responses. Fraudsters who don’t code can use AI (artificial intelligence) tools to come up with generic responses at scale. A Stanford study reports that one in three online survey takers now use AI tools like ChatGPT to answer open-ended questions. And it gets more technical than that.

Common fraud methods in market research

A grim 69% of all data quality flags in surveys are linked to various forms of fraud, and 41% are from international hackers. Fraudsters have one goal in mind, and they'll use any channel to achieve that. In one incident, one person defrauded 27 different research companies of $150k, using 2000+ emails, 700+ IPs, and 1100+ devices — quite an operation.

Here are some methods they use:

Phone farms. Picture a garage filled with smartphones and tablets, each creating individual accounts and submitting responses to your survey.

Multiple email accounts. Fraudsters set up different email addresses to sign up multiple times for your survey.

Multiple IPs or VPNs. Setting up unique IP addresses or operating behind a Virtual Private Network (VPN) allows fraudsters to disguise their location and make tracking difficult.

Programmatic or AI-generated responses. The downside of the generative AI boom is that bad actors can leverage AI to generate survey responses that sound convincing but are entirely fake.

Research fraud trends by country

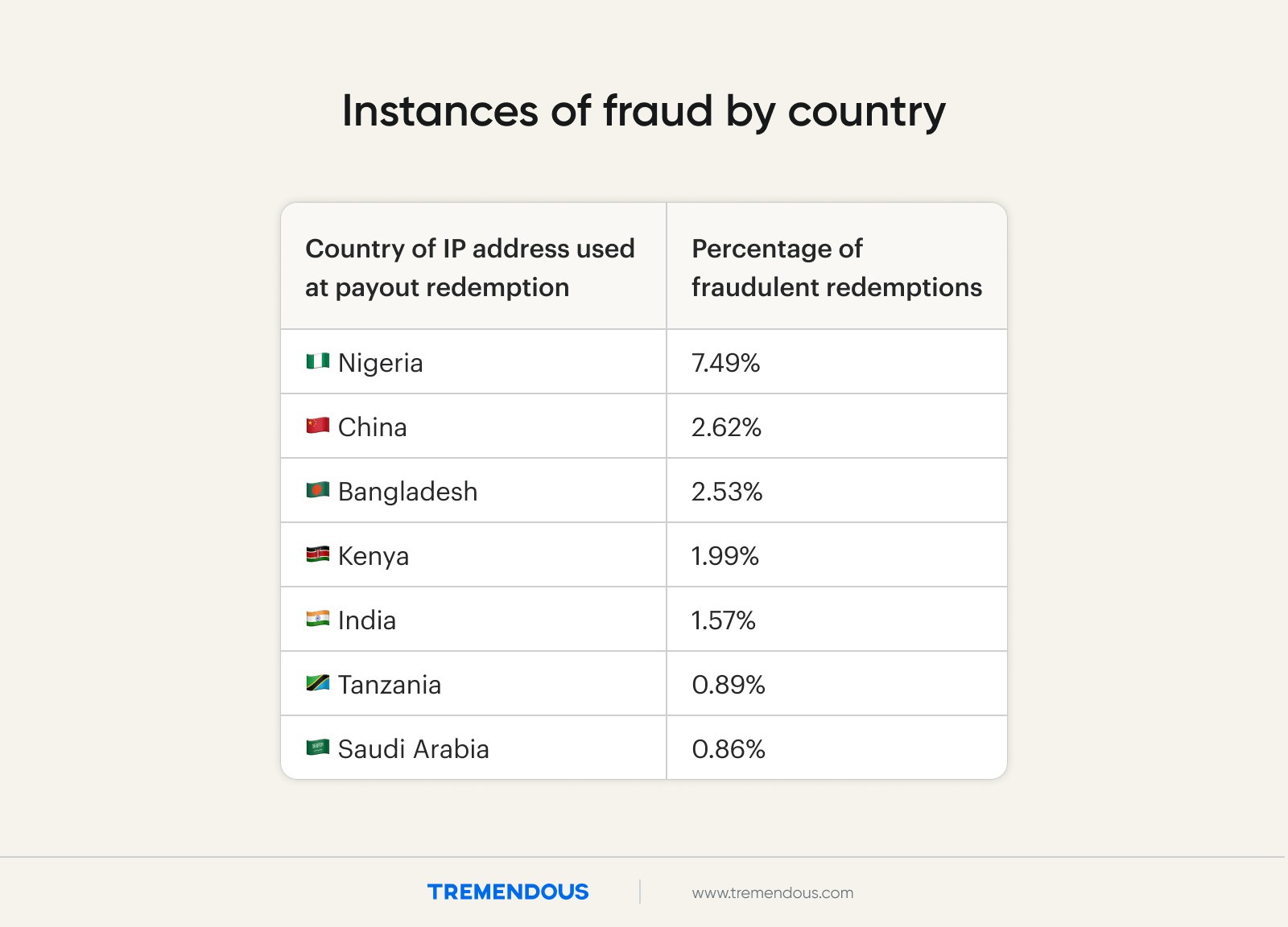

Fraudsters operate anywhere. Based on our proprietary platform data, countries like Nigeria, China, Bangladesh, Kenya, and India have emerged as epicenters of fraudulent activity.

And the frequency of fraudulent transactions is increasing YoY. Between 2021 and 2024, it jumped 14.7%.

Potential hallmarks of fraud in market research

Whenever incentives are up for grabs, fraudsters are hard at work to steal them. Here are some red flags that may indicate suspicious activity in your research programs.

Responses to open-ended questions that feel inconsistent with the participant's profile

Data that deviates from expected benchmarks or appears inconsistent with the norm

Surveys completed at speeds that seem impossible

Multiple submissions from the same IP address or device

Multiple responses were submitted at the exact same time

How to stop market research fraudsters

Overcoming this fraud challenge might seem daunting. But there are several steps your firm can take immediately to identify fraudsters and stop them from siphoning away your budget.

Fraud prevention process

The first step to fighting fraud is putting a process in place to flag and review suspicious activity. Here are a few common processes that leading market research firms use to catch bad actors.

Verify participants multiple times prior to sending payouts

Think of this as doing a quick background check on your participants. Start by looking for suspicious email addresses — random strings of numbers and letters are common. A screener survey can also help you get additional information and provide a little extra friction to deter folks hoping to make a quick buck. Lastly, you can conduct a short interview with each one, and verify their email or phone number live. (This step typically takes additional resources and time.)

Put in safeguards using IP identification and risk scoring

The next step? Tracking the digital fingerprint of your participants. A digital fingerprint is a way to identify if someone is the same person based on several different attributes, such as their email, phone number, IP address, browser data, and payout information.

Once you’re able to track the digital fingerprint of each payout recipient, you’ve got an edge. You’ll be better able to identify who’s performing fraudulent activities based on behaviors that can all be linked back to one person. From there, you’ll want to block participants and stop unnecessary payouts.

Tip: With an incentive platform like Tremendous, you can set rules to identify suspicious behaviors, such as a large number of redemptions made within a certain period, or redemptions made across multiple countries.

Share fraud data among your peers and leverage your network

Ambitious scammers who find success in easy money-making opportunities don’t just target one company — they target entire industries. Sharing fraud data with other market research firms can help everyone stop fraudsters faster and more effectively.�

Whether you connect with colleagues live at conferences or share your experiences on LinkedIn, being transparent about fraud can save you and your peers millions.

Tools and resources to fight fraud

If you want a truly accurate fraud solution, you need a system that does everything listed above and more. Piecemeal tactics aren’t as effective as a holistic defense strategy. Some common methods research firms use in fraud prevention include:

Fingerprinting. Some third-party companies provide solutions that verify research participants and screen out individuals trying to run a scheme. These programs can be helpful but costly, and vary in sophistication and friction for users.

Fraud prevention algorithms. Some firms with engineering resources can build their own standalone models to prevent fraud. Others use third-party vendors with lots of experience in the field.

Internal hires to monitor and address fraud. If your market research firm manages large client portfolios and incentive budgets, part-time or full-time hires focused on fraud can be a good investment. However, bringing on senior experts comes with a substantial price tag and operational overhead.

Protecting your participant experience

If you’re running a research project, your mission is two-pronged: Get real data from real people, and reward them quickly so they stay engaged with your firm.

Nailing both aspects can be tricky with fraudsters in the mix. You don’t want a few bad apples to ruin the party for everyone else and shut it down. Some fraud prevention programs have tight security protocols that could block payments en masse and cause frustration for everyone.

Here’s how to avoid that.

1. Combine technology and human evaluation

You’ll want to dedicate some time upfront calibrating your models and security parameters. This early work will pay off by flagging only suspicious activities and not ones that are actually fine.

Check in frequently to make sure things are on track. For instance, your technology solution may suddenly block all participants from a specific country, even though taking that extreme step isn’t necessary.

Get comfortable with the tools you have in place, and see what’s going on to avoid big mishaps.

2. Develop custom fraud flags for your firm

Fraud looks a little different for every firm. A one-size-fits-all solution can cause friction when flagging and reviewing suspicious activity. It’s important to get to know your clients and participant behaviors, then use those insights to create rules and flags specific to your industry and programs.

For instance, you can set custom thresholds for the maximum amount a recipient can claim. If you see suspicious activity originating from a specific country, you can set rules to make that region unable to participate.

Conversely, you can set up a safe list of known participants. This allows them to bypass fraud controls, take part in studies, and receive rewards faster.

3. Balance detailed reviews with timely payouts

Honest participants who answer your survey expect a fast and efficient payout. You don’t want to gum up the works with an overly lengthy review process. That’s a guaranteed headache for all parties involved.

Choose the right vendor and set the right rules, and you’ll get immediate reports on any unusual activity that demands your attention. A smooth experience ensures legitimate participants will get paid on time and increases the chances of future participation.

Summary

As market research programs grow, fraudsters are waiting in the wings to cash in. From multiple IP addresses to leveraging AI to flood surveys with bogus responses, their scam tactics are continuously evolving. When their efforts go unnoticed, especially at scale, your firm could take a financial hit.

The good news is that there are a variety of techniques and tools your firm can use to ensure the integrity of your market research data. By combining the power of technology with human intelligence, investing in custom fraud flags that make sense for your clients and panelists, and finding the sweet spot between thorough reviews and timely payouts, you’ll be well-positioned to protect your studies from fraud while still delivering a great experience for participants.