Everything you need to know about customer acquisition

By Zach Links●6 min. read●Oct 28, 2024

Customer acquisition isn’t easy. Or cheap.

Studies suggest that the cost of acquiring a new customer is 4-5x higher than the cost of retaining an existing customer.

But your company can’t reach its next stage of growth without acquiring new customers.

Customer acquisition drives revenue expansion. It's the engine that propels your business forward en route to long-term success.

In this guide, we'll break down everything you need to build your customer acquisition strategy.

Read on to learn how marketers can create an effective plan, calculate costs, and measure success. Or, skip ahead to the section you want to learn more about:

What is customer acquisition?

Customer acquisition is the process of bringing new customers to your business. It's how you attract prospects, convert them into buyers, and grow your customer base. From startups to enterprise businesses, customer acquisition is essential for sustainable growth and profitability.

A comprehensive customer acquisition strategy calls for a cross-functional effort. From marketing to sales to customer service, every part of your org is an integral part of the plan to attract new customers.

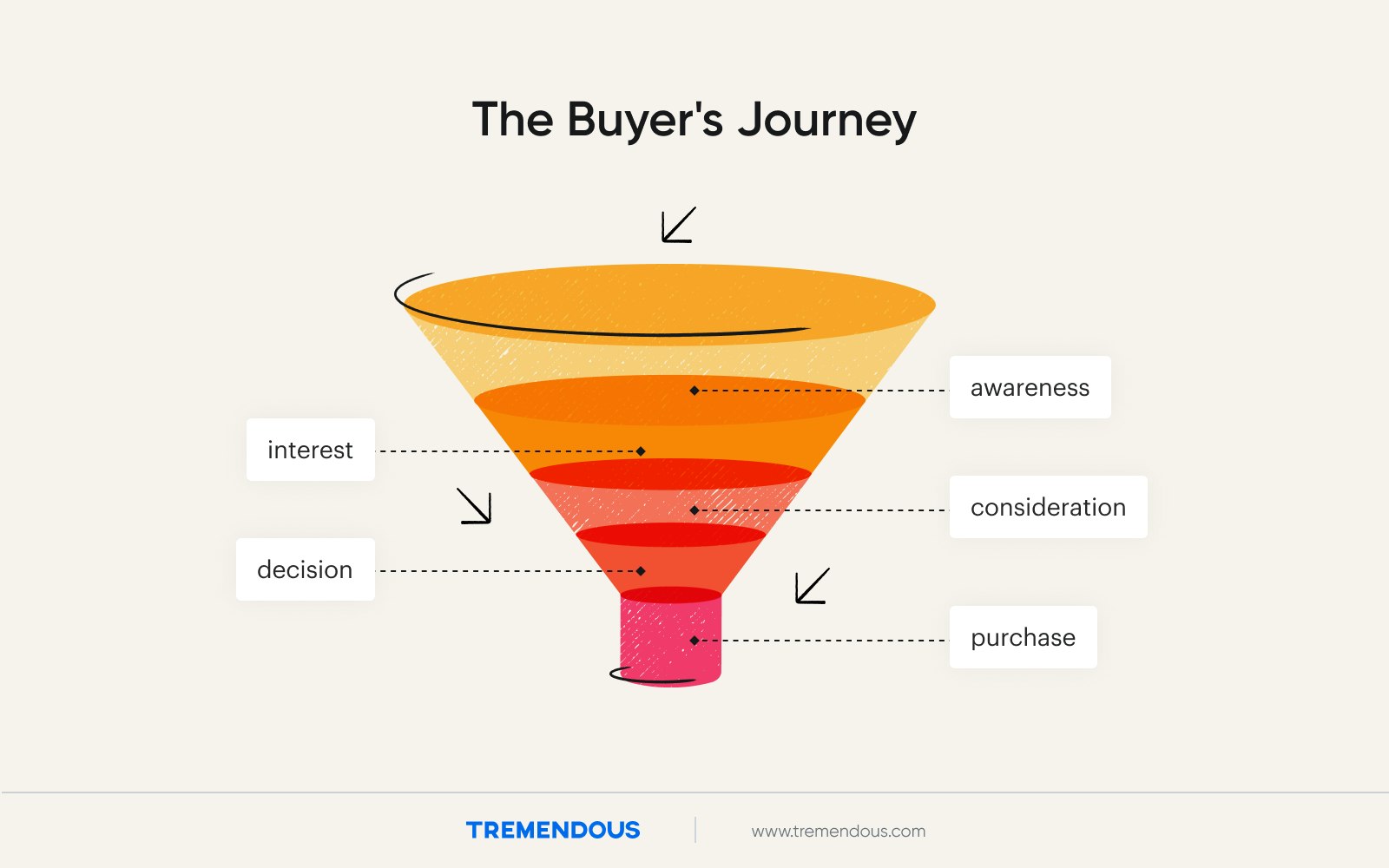

Effective customer acquisition strategies target the right audience, engage them through various touchpoints, and guide them through the buyer's journey — aka, the customer acquisition funnel.

The steps of the buyer’s journey vary by company. But most often, the funnel looks like this:

Awareness: Prospects discover your brand for the first time, usually through paid advertising or word-of-mouth recommendation.

Interest: Curious prospects gather more information about your products or services. They might visit your website, scroll social media, or look you up on review sites.

Consideration: In this phase, potential buyers might subscribe to your email list or schedule a demo.

Decision: They’re almost ready to go from browser to buyer. They might be one click away from checkout. Or weighing your company versus a competitor.

Purchase: Done deal — the prospect has been converted into a customer.

Why does customer acquisition matter?

Customer acquisition grows your business by bringing in new customers who contribute directly to your bottom line.

As you attract more customers, you're not just increasing your own revenue — you're often gaining market share at the expense of competitors, increasing long-term profitability.

The process of acquiring customers also boosts brand awareness as more people interact with your brand through various touchpoints.

Building and implementing a customer acquisition plan is an investment. But, as you develop effective strategies for bringing in new customers, you create a repeatable roadmap that can support expansion into new markets or the launch of new product lines.

Moreover: customer churn is inevitable. No company can rely on customer retention alone to stay afloat.

Before we get into a cost analysis, let’s look at all the different levers you can pull to increase customer acquisition.

The top customer acquisition channels

Your customer acquisition model will vary, depending on your industry and stage of growth.

Established companies are more likely to invest in traditional advertising than fledgling startups. And B2C fashion brands tend to focus more on influencer partnerships than, say, B2B software companies.

With that said, here are the customer acquisition channels you’ll want to explore:

Organic search

Optimizing your website for search engines can help you attract new potential customers. SEO doesn’t always yield immediate dividends, but smart keyword placement and high-quality content can push you towards the top of the page.

Paid search

Platforms like Google Ads can position your site at the top of search results. With paid search, you can precisely target high-intent searchers in key demographics.

Social media

Personalized advertising can reduce customer acquisition costs by as much as 50%. Platforms like Facebook, Instagram, TikTok, and LinkedIn enable a high degree of personalization through both paid and organic advertising. The key is to tailor your content to each audience and fine-tune your approach over time.

Content marketing

This includes blog posts, videos, podcasts, and infographics. Quality content educates and informs your audience, positioning your brand as a trusted resource and indirectly driving sales.

Email marketing:

Inbox access is incredibly valuable. With proper segmentation and targeting, email marketing can deliver one of the highest ROIs of any customer acquisition channel.

Referral programs:

Encouraging existing customers to refer new ones through incentives. It pays to reward referrals — referred customers are 200% more likely to spend than non-referred customers.

Influencer partnerships:

Influencers are particularly effective for reaching niche markets and younger prospects who may be skeptical of legacy media. Companies can leverage the trust and rapport influencers have built with their followers to draw highly qualified leads.

Events:

In-person and virtual events provide opportunities for direct interaction and relationship-building. Depending on your industry, you can use trade shows, webinars, and live demos to raise awareness for your brand.

Traditional advertising:

TV, radio, print, and out-of-home ads tend to be more expensive than digital ads. Still, legacy media can still be effective when targeting demographics that are less active online.

Public relations:

PR can provide third-party validation for your brand and help you reach audiences that might be difficult to access through other channels.

The avenues that make the most sense for your business will depend on more than just your industry and ideal customer profile (ICP). It’ll also depend on how much you can afford to spend per customer while still turning a profit.

Calculating customer acquisition

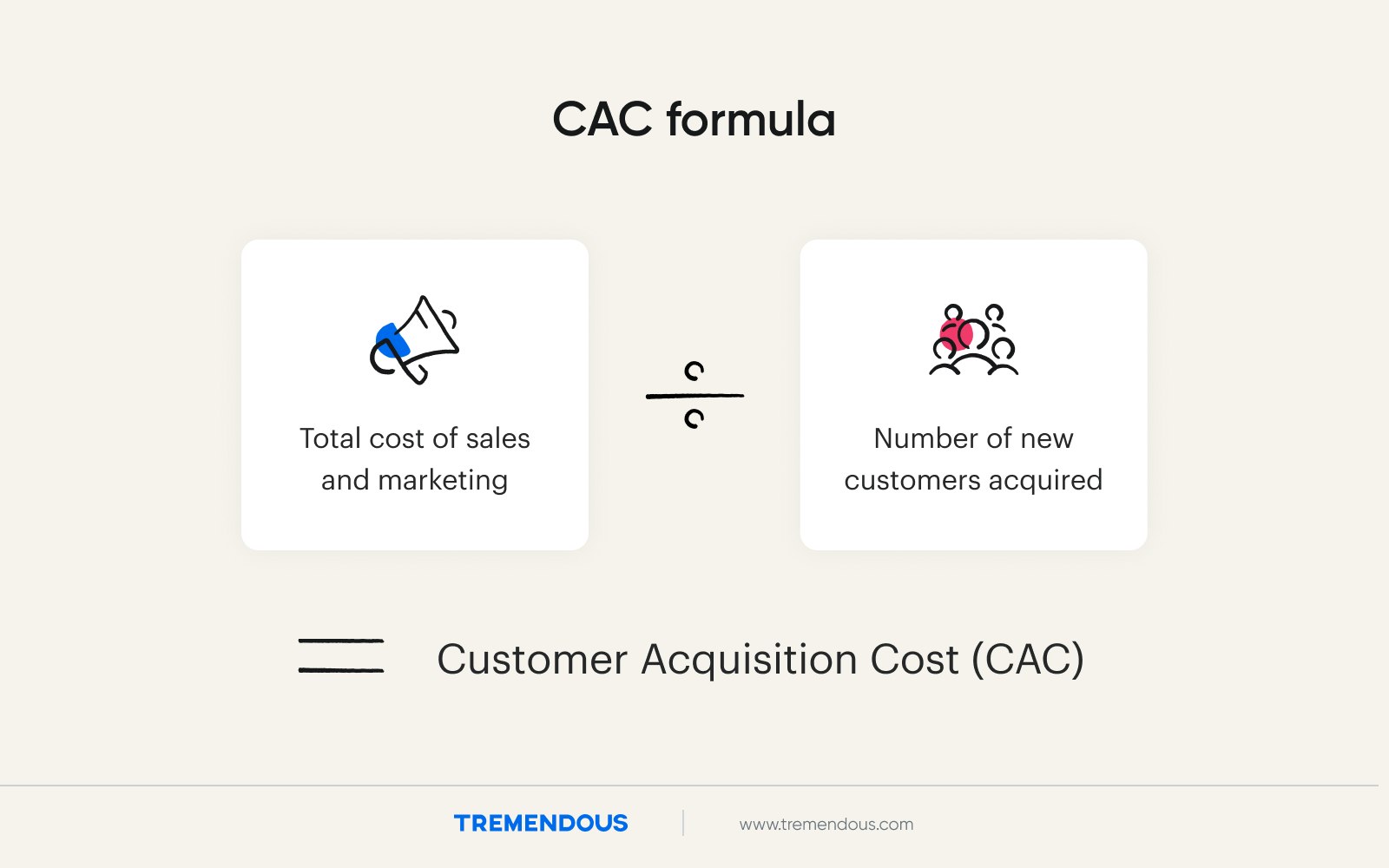

Understanding your customer acquisition cost (CAC) is crucial for measuring the effectiveness of your acquisition efforts.

The basic formula is:

CAC = Total cost of sales and marketing / Number of new customers acquired

So, if you spent $5,000 in a month and acquired 100 new customers, your CAC would be $50.

CAC = $5,000 / 50 = $50

Of course, your spend doesn’t just include your advertising spend. For your true CAC, consider including all costs associated with acquisition, including marketing team salaries, sales team salaries, recurring software subscriptions, and any additional overhead.

A more comprehensive CAC formula might look like this:

CAC = (Marketing costs + Sales costs + Wages + Software + Additional overhead) / Number of new customers acquired

Knowing your CAC helps you assess the efficiency of your acquisition efforts and the profitability of different customer segments. From there, you can make more informed decisions about where you’re allocating resources and set realistic customer lifetime value (CLV) goals.

Remember, a "good" CAC varies by industry, business model, and company size. A food delivery app might aim for a CAC of $5-7. But a B2B SaaS company’s ideal CAC could be in the $300-$500 range.

As a general rule of thumb, your CAC should be at least three times lower than your CLV.

How to create a customer acquisition strategy

No matter your industry, you can build a plan that converts new customers by following these core steps.

Step 1: Know your customers

You have to know what the people want in order to convert them into customers. And you can’t get there through guesswork.

Create buyer personas with detailed profiles of your ideal customers, including demographics, buyer behaviors (patterns of purchasing decisions), pain points (specific problems they face), and goals. These personas will be your north star as you tailor messaging for each audience.

Leverage the data you already have on your current customers. Consider the channels that first brought them to your company and the messaging that keeps them coming back for more. This messaging should include the value proposition — the unique benefits of your product or service — that resonate most with your customers.

Develop a messaging framework — a structured approach to communicate your value prop consistently across channels. This framework should articulate your key messages, tone of voice, and how you address customer pain points.

Remember, customer feedback doesn’t just help with retention — it’s the key to understanding the evolving needs and preferences that will shape your acquisition efforts.

Customer and market research — surveys, interviews, and focus groups — can uncover fresh insights into consumer preferences.

By truly knowing your customers, you'll craft acquisition strategies that hit the mark, resonate with your audience, and drive conversions.

Step 2: Establish your goals

Use the SMART framework to make your goals Specific, Measurable, Achievable, Relevant, and Time-bound. This ensures that your acquisition goals will support your overall business growth targets.

For instance, if your company aims to increase market share by 5% this year, your customer acquisition goal might be to attract 1,000 new customers from your primary competitor's user base. This aligns your acquisition efforts directly with your broader business objectives, ensuring every new customer brings you closer to your overarching targets.

It’s also important to focus on quality — not just quantity.

High-value customers often lead to better ROI and long-term business sustainability. The customers that build a deep connection with your brand are 15x more likely to recommend your company to others. And, with repeat business, loyal customers are worth 10x as much as their first purchase.

You’ll also want to define your goals for acquisition — continually monitor metrics including CAC, CLV, and conversion rates to optimize your strategy.

Well-defined goals provide direction and help you measure the success of your acquisition efforts.

Step 3: Segment and score your leads

Not all leads are created equal. Segmenting them allows for more targeted and effective acquisition efforts.

Use behavioral segmentation to group leads based on their actions, such as website visits, content downloads, or email engagement. You can also categorize leads by where they are in the decision-making process and implement lead scoring — rank prospects based on their behaviors to prioritize your highest-potential leads.

Effective segmentation allows you to personalize messaging and offers, allocate resources more efficiently, and, ultimately, improve conversion rates.

For example, a SaaS company might assign points to different actions: 10 points for downloading a white paper, 20 points for attending a webinar, and 50 points for requesting a demo. A lead with 80 points would be considered "hot" and prioritized for immediate follow-up, while a lead with 30 points might receive more nurturing content — educational material to build trust and move them closer to a purchase decision.

This system helps your sales team focus their efforts on the leads most likely to convert, improving efficiency and conversion rates.

Segmentation is essential for continued customer acquisition. Regularly review and refine your segments as you gather more insights.

Step 4: Pick your channels

Analyze your audience to determine where your potential customers spend their time and how they engage with brands.

The most effective channels will vary depending on your industry and target market.

B2B companies often find success with LinkedIn for professional networking and thought leadership, content marketing (whitepapers, case studies) for lead generation, email marketing for nurturing leads, and industry-specific events and webinars.

B2C brands, on the other hand, typically thrive on platforms like Instagram and TikTok where they can showcase their products. They can also look to Facebook for broad demographic targeting, influencer partnerships for niche markets, and SEO for high-intent searches.

SaaS companies also tend to leverage Google Ads for high-intent keyword targeting. They could also leverage Product Hunt for launches and YouTube for product demos and tutorials. And, to foster community engagement, they could consider paid advertising on Reddit.

E-comm brands often prioritize Pinterest for inspiration-driven purchases, Instagram Shopping for seamless mobile purchases, and retargeting ads to recapture abandoned carts.

Assess which channels are currently delivering the best results in terms of lead quality and CAC. If you look to expand into a new channel, consider the costs and resources involved.

Look at competitors to identify which channels they are using successfully (or unsuccessfully).

Test and iterate by starting with a few channels, measuring results, and adjusting your strategy based on performance.

Step 5: Create personalized campaigns

Personalization is key to effective customer acquisition. Dive deeper into your persona research to create truly personalized campaigns that will resonate with each audience.

Conduct in-depth interviews with existing customers and prospects. Analyze how customers interact with your brand across various touchpoints. Use industry reports and market research to understand broader trends and interests relevant to your target audience. Gather insights from customer support interactions or sales team feedback to identify common questions, concerns, and preferences.

For B2B companies targeting high-value accounts, consider implementing Account-Based Marketing (ABM) campaigns. ABM focuses on a small number of high-potential accounts, delivering hyper-personalized content and experiences. This approach often yields higher ROI for companies targeting enterprise clients.

When crafting your campaigns, use the insights from your research to tailor your communications. This includes the tone, content format, offer type, and even the time of day you reach out.

For example, if your research reveals that a particular segment prefers video content and values sustainability, you can create eco-focused videos and distribute them on platforms where they’re most active.

Remember that personalization extends beyond just the initial touchpoint. Ensure that your entire customer journey — from the first interaction to post-purchase follow-up — is tailored to each persona's preferences and needs. This cohesive approach increases the likelihood of conversion and sets the stage for long-term customer relationships.

Continuously refine your personalized campaigns based on performance data. A/B test different elements of your campaigns to identify what resonates best with each persona. Use these insights to continuously improve your personalization efforts and acquisition results.

Examples of cost-effective customer acquisition strategies

You might consider traditional advertising as a part of your customer acquisition strategy, depending on your industry and target audience. But, in general, it’s not the most cost-effective way to grow your base.

Fortunately, there are plenty of budget-friendly alternatives. Here’s a look at some real-world examples of cost-effective customer acquisition strategies.

Google Workspace’s cash incentive program

Casper incentivized referrals with Amazon gift cards, flexible rewards that could be redeemed for just about anything. But cash can be a powerful motivator too.

Google Workspace — fka G Suite — offers cash payouts for every successful referral.

The reward amount varies depending on which plan new customers choose. For the Business Starter plan, it’s $8 per signup. For Business Standard, it’s $15 per signup. And, for Business Plus, it’s $23.

Unlike other referral programs with low caps, users can get rewarded for up to 100 referrals per year. Plus, Google sweetens the pot for new customers with a first-year discount.

Internet marketing firm ManagedAdmin made $10,000 a month by sharing Google Workspace referral links and promo codes. And Google was happy to cut the check.

Let’s say that there was an even distribution across the three plans. Google would make $12/user/month from the end client.

That’s $140K+ in annual recurring revenue in exchange for a one-time payout of $10K. And that’s a conservative estimate.

The program's tiered structure offers higher rewards for more expensive plans. That incentivizes partners like ManagedAdmin to promote premium offerings, increasing Google's revenue even further.

While partners earn substantial rewards, Google acquires valuable long-term customers. It’s a win-win. And it’s extremely cost-effective for the tech giant.

Spotify's year-end "Wrapped" campaign

Spotify's annual "Wrapped" campaign drives acquisition and retention with viral, user-generated content.

Each December, Spotify provides users with personalized summaries of their listening habits for the year.

The summaries, which are easily shareable on social media, encourage users to post their top artists, favorite genres, and total listening minutes, effectively becoming brand ambassadors for Spotify.

The campaign generates massive buzz and FOMO (fear of missing out) among non-Spotify users.

In 2020, Spotify saw a 21% increase in app downloads during the Wrapped campaign period. The campaign also drove a surge in social media mentions and searches for Spotify.

This strategy is cost-effective as Spotify leverages existing data and repackages it in an engaging, shareable format. The users themselves do most of the promotion, resulting in organic reach and authentic endorsements.

By tapping into people's desire to share their tastes and experiences, Spotify created a cultural moment that retains existing users and attracts new ones — at a fraction of the cost of traditional advertising.

Duolingo's gamification and social media strategy

Duolingo, the language-learning app, has powered its acquisition through thoughtful gamification and social media engagement.

The app's core strategy revolves around making language learning fun, addictive, and shareable.

Duolingo's gamified approach includes streaks, leaderboards, and in-app currency. This creates a sense of achievement and competition, encouraging users to return daily and share their progress. The app's push notifications, often featuring their mascot owl, have achieved meme status, further expanding their reach.

In 2021, Duolingo took TikTok by storm, featuring their owl mascot in humorous, trend-savvy videos. This content helped Duolingo tap into younger demographics and stay culturally relevant.

The company also leverages user-generated content, encouraging learners to share their Duolingo achievements on social media. This organic, word-of-mouth marketing has been crucial in driving new user sign-ups.

Duolingo's multi-pronged approach to customer acquisition has yielded massive results with 800 million total downloads and a $9 billion market cap. Their cost-effective strategy of combining gamification with clever social media marketing has made them a leader in the language learning space, all while keeping customer acquisition costs low.

Customer acquisition vs. retention

While customer acquisition is crucial for growth, it's equally important to focus on customer retention.

A 5% increase in customer retention can lead to a 25-95% increase in profits, according to Frederick Reichheld of Bain & Company.

And research from the book Marketing Metrics suggests that businesses have a 60-70% chance of selling a product or service to an existing customer, versus just 5-20% for new customers.

The bottom line: Customer acquisition and customer retention are both essential. And complementary.

Referred customers carry a 4x higher lifetime value than non-referred customers. And they convert 5x faster than customers acquired through other means.

Your existing customers can be your best brand advocates. Satisfied, loyal customers are more likely to refer others, reducing acquisition costs through word-of-mouth marketing.

For a more balanced approach, consider:

Implementing a customer loyalty program

Loyalty program members generate up to 18% more incremental revenue than non-members. And, in addition to driving repeat business, loyalty programs can be used to drive acquisition. Sephora’s “Refer & Earn” promotion offers members 500 points for every referral. Pretty smart.

Offering exclusive benefits or early access to loyal customers

This could include pre-launch product access, members-only events, or special discounts. Communicate these exclusives clearly to make customers feel valued and special.

Providing excellent customer service to build long-term relationships

Train your team to solve issues and offer remedies to make your customers happy. In a survey on service failures, 98% of respondents said that if a company resolves a service failure and offers a discount or gift card, they’ll remain loyal. But, without a reward, that number falls to 63%.

Gathering and acting on customer feedback

Regularly conduct surveys and analyze customer interactions to identify areas for improvement. According to a Microsoft report, 77% of consumers view brands more favorably if they seek out and apply customer feedback. Close the feedback loop by informing customers how their input has led to changes or improvements.

Using customer data to anticipate needs and provide proactive solutions

Analyze purchase history and browsing behavior to predict what customers might need next. According to Salesforce, 62% of consumers expect companies to anticipate their needs. Implement predictive analytics to stay one step ahead of customer demands and provide timely, relevant offers.

Developing a strong onboarding process to set new customers up for success

Create clear, engaging tutorials and resources to help customers get the most out of your product or service. Customers are more likely to stay loyal to a business that invests in onboarding content that educates them after their purchase. Consider implementing a personalized journey based on the customer's specific needs and goals.

Remember, while acquisition brings in new business, retention ensures sustainable growth and profitability.

Make new friends. But keep the old.

Conclusion

By developing a robust customer acquisition strategy and continually refining it, you can ensure sustainable growth for your business. Ultimately, it’s not just about quantity, it’s about quality — getting the right customers who will bring long-term value to your company.

As you build your customer acquisition strategy, remember to:

Understand your target audience thoroughly.

Set clear, measurable acquisition goals.

Segment your leads for more effective targeting.

Choose the right mix of acquisition channels for your business.

Create personalized, omnichannel campaigns.

Continuously track and optimize your CAC and ROI.

Learn from successful acquisition strategies in your industry.

Balance acquisition efforts with strong customer retention practices.

Driving customer acquisition with Tremendous

Tremendous enables companies to automate the sending of rewards, making it easy to incentivize first-time customers. Our platform simplifies the process of sending W9 forms, ensuring compliance with minimal effort.

With no fees, companies only spend what they send, making Tremendous a cost-effective solution for customer acquisition initiatives. Our global reach extends to 200 countries, allowing customers to choose from 2,000+ great rewards that can be redeemed instantly.

Tremendous is perfect for referral programs, helping you turn satisfied customers into brand advocates. You can use our platform to convert first-time buyers into loyal repeat customers through well-designed loyalty programs – all managed within a single system.

If you're interested in launching a customer acquisition initiative, schedule time with our team today.